Turn the transition into an opportunity, learn how to avoid taking unmanaged major risks.

“The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy. When I hear complaints about less liquidity, remember there is such a thing as too much liquidity.”

Paul Volcker

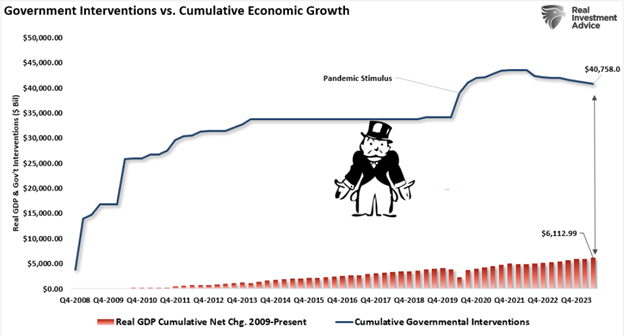

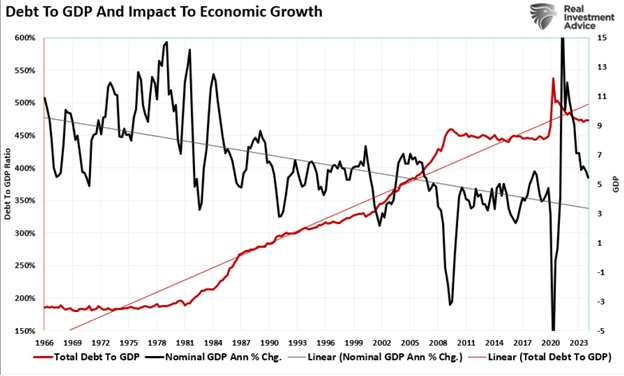

“How has all that excess liquidity helped the economy? Well, despite the most aggressive monetary expansion in history, total bank lending (business, consumer, real-estate) during the 14-year period from 2008 to 2022 grew at just 3.4% annually, the slowest growth rate in U.S. history since 1947.”

John Hussman

“The professional Political Class will do nothing to cut inflation because they need inflation to disguise the monster deficit and debt accumulation required to direct to and satisfy both the Donor & Entitlement Dependent Class.”

Gordon Long

Let’s be clear about the financial direction of the US.

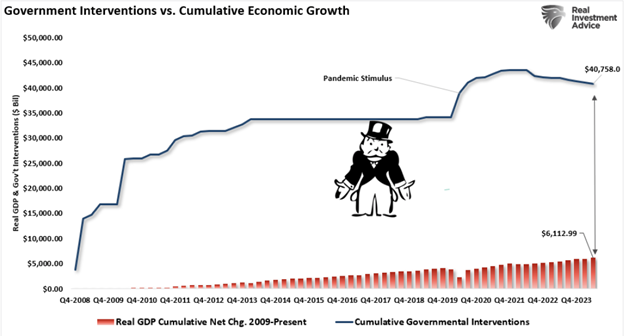

Increasingly debt and welfare are consuming a greater share of the economy, which is on a declining growth trend. MMT is assumed to be the solution but you can’t borrow your way of a debt crisis. Wages continue to fall behind the real cost of living, and small business is in a depression. Financial overstimulation is boosting large company asset prices so the wealth inequality continues to rise, and the wealthy elites become ever more influential.

While this may continue for some time it is clearly unsustainable and investors need to be increasingly selective and ready for instability.

It is important to be real clear today about your expected return and the time horizon you are considering for your investments. Policy has become unprecedented and reckless to a degree unimaginable a few decades ago. This makes the economy and markets increasingly unstable and distorted.

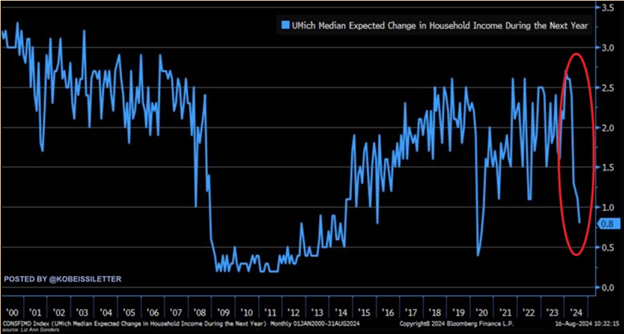

The quotes above relate to the dramatic changes in both monetary and fiscal policy in recent years. Policy has already proved to be destructive for US economic GDP growth over the post 2008 period. The economic payoff for the biggest interventions in history can only be described as pitifully weak in GDP terms.

While the massive infusion of money created has raised asset prices substantially, the benefit has been very uneven.

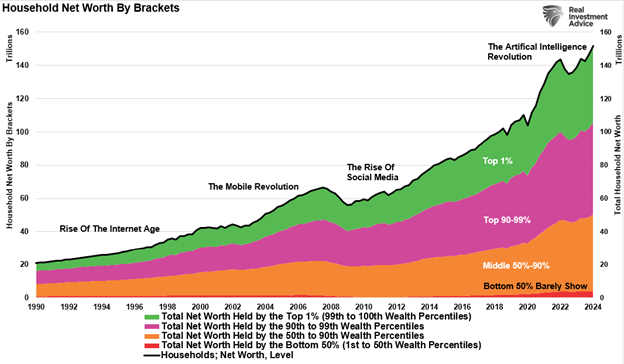

Economic challenges are a major problem for most of the population. A normal life seems to be beyond the means of the younger generations and at least 50% of the population. House prices are nearly 8 times average earnings, putting house purchases beyond the majority of the population. Furthermore, the prospects for household income are at lows only seen twice in the last two decades.

It is only by understanding how much policy has changed and how it has effected the economy and stock market that you will be able to genuinely answer the title question for yourself.

For a better understanding of the policy predicament review the video below. The Fed has led us so far off normal conditions the Fed itself seems very unsure about its next policy steps. Chris Whalen describes the situation.

The Fed Is Afraid To Really Fight Inflation | Chris Whalen

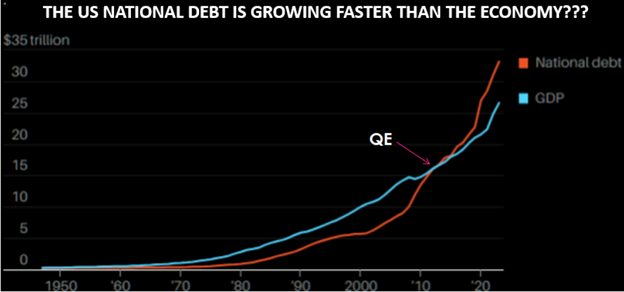

The main driver of the stock market has been public debt, which, as the CBO has laid out has become unpayable in real terms. Even the Fed Chair has said exactly that.

The US National Debt has grown twice as fast as GDP since 2000.

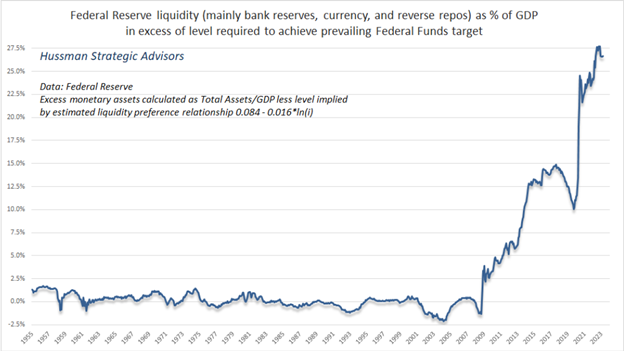

All this debt has been enabled by excessive liquidity.

What about quantitative easing? Well, recall that there’s a very well-defined relationship, in data since 1928, between the ratio of Fed liabilities/nominal GDP and the level of short-term interest rates. This also allows us to estimate the quantity of Fed liabilities (as a fraction of GDP) over-and-above the amount that have historically been necessary to achieve the Federal Reserve’s prevailing target for the Fed funds rate.

John Hussman

From there it is possible to calculate excessive liquidity.

As this debt machine has relentlessly accelerated, it is clear that nominal growth has relentlessly declined. This policy is an epic failure!

The real economy is getting squeezed hard.

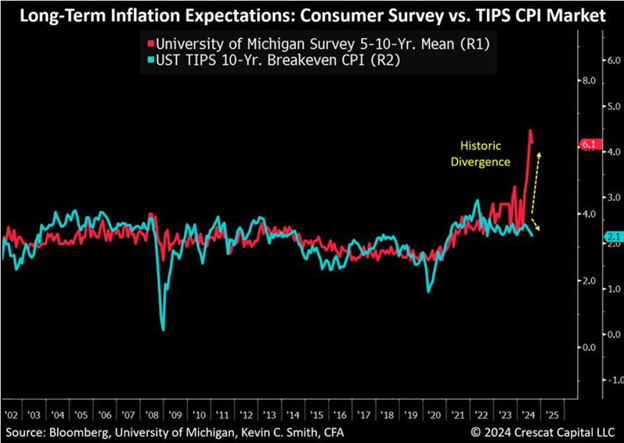

Even as nominal GDP declines, long term inflation expectations have begun to rise. Consumers have lost confidence in the ability of policy to contain inflation. They see what clearly concerns the Fed! So real GDP is declining even faster than Nominal GDP.

No wonder that the small business sector is in a depression

The stock market divergence from the economy is historically extreme

The stock market has been the greatest beneficiary of the persistently excessive departure of policy from sustainable norms. However, it has now diverged from its connection to the economy to a record degree and has become dependent on ever more excessive and unsustainable policy measures.

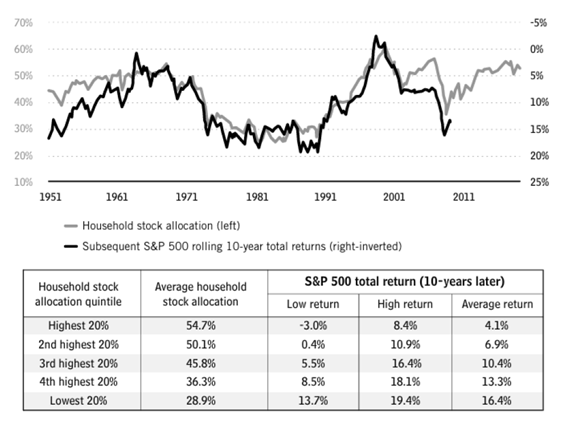

Long term investors, and particularly passive investors, need to have a clear understanding about what historic stock market extremes mean for investment performance. Particularly now, when continuation has become increasingly dependent on unsustainable policy.

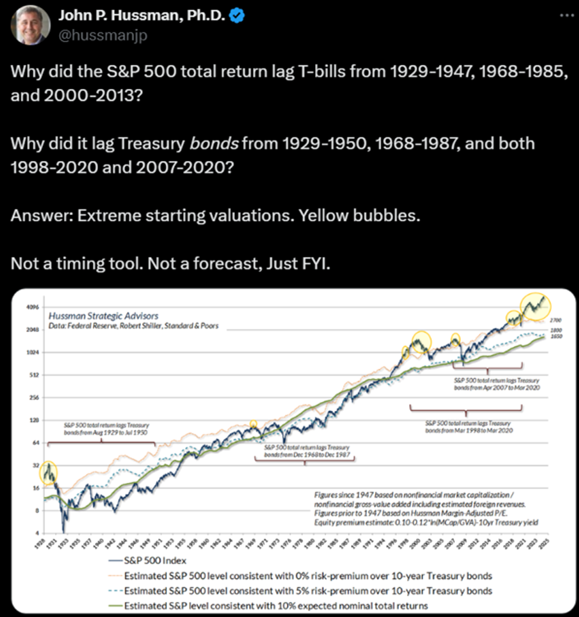

The chart below shows key valuation levels for US equities over the last 100 years. The stock market has never been this overvalued before.

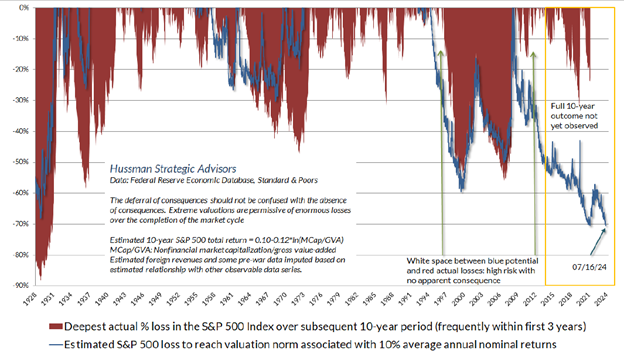

What does history tell us about the scale of the possible correction in equities yet to come? History suggests it could be as much as 70%!

Economic policy has put the markets into a very dangerous predicament. Retirement accounts now require skillful management to safely get through this situation. Yet policy continues to double down at any sign of a stock market correction. Currently MMT clearly can’t work economically in the long term, and any alternative solution will also take many years of transition.

The Debt Crisis Also Presents Great Opportunity For Investors | Gordon Long

Gordan Long has Done great work on this transition so it is worth reviewing his summary and considering in greater detail how and why the system now has to change and how it might take shape.

Investors need to carefully think through what has already happened. Policy on its current path it will become increasingly stagflationary, and yet any policy reset will also need to be understood and adjusted to.

Most of the asset management industry is broadly set on passive allocations, so few investors are likely to be well prepared for the major transitions that are now inevitable.

The most difficult part of investing today is understanding how much economic policy has changed. Once this is understood you can see how risky and unstable conditions have become. So, you need to be clear. How will you adapt you approach to ensure investment success? This situation will require the skills of a “Best Investor”. Review how volatility can be turned into the “low risk road to high returns”, in my book Invest Like The Best.

The optimal strategy is compounding.

The optimal strategy, no matter what, is compounding. When conditions become challenging compounding becomes a standout approach. Compounding can be precisely defined in real time, and it is fully adopted by all the most successful investors of all time. I have video of Warren Buffett saying exactly that.

If you are not sure you are compounding, then you are speculating, or gambling. You have very little idea where you will end up a decade or so from now, as you do not have a secure and consistently productive investment approach or process for a time of instability.

What is your Investment Objective, and process of Assessment?

The history of passive investing is consistent long-term underperformance. Behaviorally, it is natural to chase performance, but that generally leads to buying higher levels and selling lower levels. It also needs to be understood that passive investing is not low risk investing. It involves keeping losses indefinitely no matter the size of the loss. That means losses can get substantial.

The above chart is taken from my book.

Passive Investing “could not fail to be tragic” as a reliable compounding strategy for equities, within a reasonable timetable for the individual.

Passive investing was popular in the 1920s and led to widespread wealth destruction in the 1930s. Warren Buffett’s teacher and mentor was Benjamin Graham and in his timeless investing book, still regarded as an investment classic, he described the adoption of passive investing as follows:

“Along with this idea as to what constituted the basis for common-stock selection emerged a companion theory that common stocks represented the most profitable and therefore the most desirable media for long-term investment. This gospel was based on a certain amount of research, showing that diversified lists of common stocks had regularly increased in value over stated intervals of time for many years past.

“These statements sound innocent and plausible. Yet they concealed two theoretical weaknesses that could and did result in untold mischief. The first of these defects was that they abolished the fundamental distinctions between investment and speculation. The second was that they ignored the price of a stock in determining whether or not it was a desirable purchase.

“The notion that the desirability of a common stock was entirely independent of its price seems incredibly absurd. Yet the new era theory led directly to this thesis… An alluring corollary of this principle was that making money in the stock market was now the easiest thing in the world. It was only necessary to buy ‘good’ stocks, regardless of price, and then to let nature take her upward course. The results of such a doctrine could not fail to be tragic.”

Benjamin Graham and David l. Dodd, security analysis, 1934

Investing can be turned into a much better framework, and there are great opportunities to come

Step One. Rethink your Investment Objective and so also your method of investment assessment. If all you do is look at returns and then invest you are likely to achieve the same results as everyone else as shown above.

Step Two. Adopt Compounding as your Approach. All the most successful investors do. If you don’t, you have very little idea or control over how your long-term return will turn out, and limited capital security.

Step Three. All your strategies should fit a compounding framework. This is easier today that it ever has been.

Step Four. Adopt real time compounding metrics for your assessments. This will automatically upgrade your investment selection and ultimately your results.

All these steps are described in detail in my book “Invest Like The Best”.

Next week the focus will be on opportunities, and likely rotations across asset classes that are emerging.If you want to discuss changing your investment strategy to compounding and address the inevitable changes then get in touch by setting up a discussion. https://calendly.com/chriscbim/meeting